Account Profile – $2,322,000 Final Bond

WE MAY BE ABLE TO QUOTE COMPANIES WITH CREDIT SCORE OR OTHER FINANCIAL ISSUES.

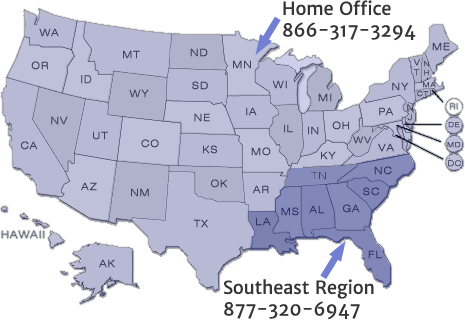

If you have any questions or need more information about our Bond Application, don’t hesitate to contact us – Jim Dillenburg jdillenburg@ccisurety.com 866-317-3294

Our Home Office handles SBA Bond Guarantee Program situations in Maine, Vermont, New Hampshire, Massachusetts, Connecticut, New York, Pennsylvania, New Jersey, Rhode Island, Delaware, Maryland, Virginia, West Virginia, Ohio, Kentucky, Tennessee, Arkansas, Texas, Oklahoma, Kansas, Missouri, Illinois, Indiana, Michigan, Wisconsin, Minnesota, Iowa, Nebraska, South Dakota, North Dakota, Montana, Wyoming, Colorado, New Mexico, Arizona, Utah, Idaho, Nevada, Oregon, Washington, California, Hawaii, Alaska, and Washington D.C.

Payment & Performance ★ Bid ★ ERISA ★ Motor Vehicle Dealer Bonds ★ BMC-84 ★ Wage & Welfare ★ License and Permit ★ Commercial ★ Contract ★ Miscellaneous

Please Note: We can always get started working on any bond application that you have already prepared for other markets. CCI Surety, Inc. specializes in hard to place contract bonds that may have previously been declined by other sureties. We use different kinds of tools which allow us the freedom to think outside the box with our underwriting strategy. We are able to get comfortable with difficult situations using escrow / funds control, SBA Surety Bond Guarantee program and working capital deposits as different options to get the bond approved. CCI also has a very successful Easy Start Program for contracts between $250,000 and $1,000,000 that may be obtained with a two page application plus any financial documents that are available. On commercial bond business we handle both standard and non standard business. Contract Bonds – Multiple Markets – Can Provide A+ rated bonds – $3M in-house authority, up to $15M from home office – Quick Turn around – No Agency Requirements SBA Backed Bonds – 2012 National SBA Bond Producer of the Year – Potential to approve bonds even with negative working capital – SBA Bond Program now covers bonds up to $6.5M and in some cases $10M Commercial Bonds – Standard and Non-Standard Bonds – Experienced staff specialized in handling Commercial Bond needs – License and Permit, Fidelity, ERISA, Business Services and Court Bonds – Miscellaneous Bonds