CPA Relationships

Financial sophistication is a limiting factor in obtaining bonds for many types of clients. In particular, contractors requiring bid or payment & performance bonds typically need CPA prepared financials in order to obtain bonds. CCI Surety specializes in bonds for clients that typically have weak financials, poor credit scores, or other difficulties that a new or existing CPA relationship can help overcome.

Insurance Agents

Most of CCI Surety’s bond business comes from insurance agents that all ready work with a client. If you have a CPA client that also has an insurance agent working on a bond need, then it still makes sense for the CPA, Insurance Agent, and a CCI Surety Underwriter to work together.

CPA Referrals

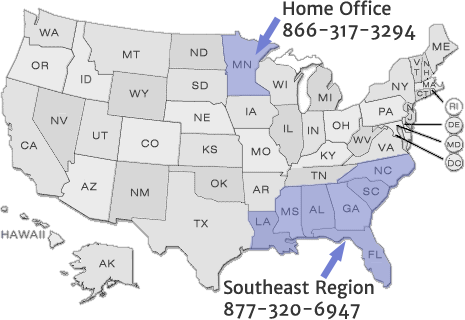

Many of the clients that CCI Surety works with do not have an existing CPA relationship. In these cases, we recommend our client to CPAs in their area. While CCI is nationwide, CPA relationships generally require a local contact person, therefore we are always looking for CPAs across the country that are familiar with helping clients organize their financial statements to assist in bond underwriting.

Developing Small and Mid-sized Companies

Many companies are successful without ever needing a bond. However, when a company works with a CPA to sophisticate their financial reporting, it is usually a step towards growth. Contractors for example may not need bonding on projects under $100,000.00; when they move to larger projects and growth, there is an opportunity for a new CPA relationship with a company poised for growth.

Payment & Performance ★ Bid ★ ERISA ★ Motor Vehicle Dealer Bonds ★ BMC-84 ★ Wage & Welfare ★ License and Permit ★ Commercial ★ Contract ★ Miscellaneous