Florida Motor Vehicle Dealer Bond Renewals

General Information about the Florida Motor Vehicle Dealer Bonds

The deadline to renew Florida Motor Vehicle Dealer Bonds is approaching. Renewal notices may be sent as early as this week which means clients will soon be looking to renew their bonds by the April 30th Deadline. CCI Surety, Inc does handle commercial bonds as well as court, miscellaneous, and many other types of bond needs. Contact us for competitive rates, especially if your client has renewal issues or if credit score has caused them difficulty in the past

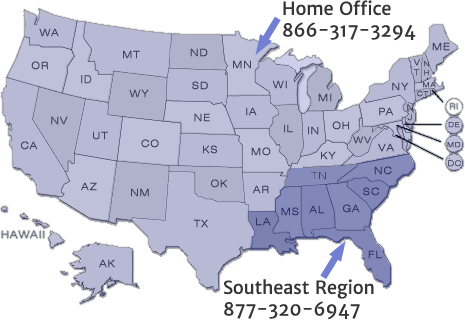

Ask for our commercial bond department at 866-317-3294, or just reply to this email.

Contact CCI Surety for Motor Vehicle Dealer Bonds

- CCI Surety can potentially quote clients with low credit score

- CCI Surety deals with multiple markets nationwide

- CCI Surety can provide quotes on standard accounts as well as non-standard accounts

WE MAY BE ABLE TO QUOTE COMPANIES WITH CREDIT SCORE OR OTHER FINANCIAL ISSUES.

If you have any questions or need more information don’t hesitate to contact us.

Jim Dillenburg

jdillenburg@ccisurety.com

866-317-3294

Our Home Office handles Motor Vehicle Dealer Bond situations in Maine, Vermont, New Hampshire, Massachusetts, Connecticut, New York, Pennsylvania, New Jersey, Rhode Island, Delaware, Maryland, Virginia, West Virginia, Ohio, Kentucky, Tennessee, Arkansas, Texas, Oklahoma, Kansas, Missouri, Illinois, Indiana, Michigan, Wisconsin, Minnesota, Iowa, Nebraska, South Dakota, North Dakota, Montana, Wyoming, Colorado, New Mexico, Arizona, Utah, Idaho, Nevada, Oregon, Washington, California, Hawaii, Alaska, Florida, Georgia, Alabama, Mississippi, Louisiana, Tennessee, North Carolina, South Carolina and Washington D.C.

Payment & Performance ★ Bid ★ ERISA ★ Motor Vehicle Dealer Bonds ★ BMC-84 ★ Wage & Welfare ★ License and Permit ★ Commercial ★ Contract ★ Miscellaneous

Please Note: We can always get started working on submissions or applications that you have already prepared for other markets. CCI Surety, Inc. specializes in hard to place contract bonds that may have previously been declined by other sureties. We use different kinds of tools which allow us the freedom to think outside the box with our underwriting strategy. We are able to get comfortable with difficult situations using escrow / funds control, SBA Surety Bond Guarantee program and working capital deposits as different options to get the bond approved. CCI also has a very successful Easy Start Program for contracts between $250,000 and $1,000,000 that may be obtained with a two page application plus any financial documents that are available. On commercial bond business we handle both standard and non standard business. Contract Bonds – Multiple Markets – Can Provide A+ rated bonds – $3M in-house authority, up to $15M from home office – Quick Turn around – No Agency Requirements SBA Backed Bonds – 2012 National SBA Bond Producer of the Year – Potential to approve bonds even with negative working capital – SBA Bond Program now covers bonds up to $6.5M and in some cases $10M Commercial Bonds – Standard and Non-Standard Bonds – Experienced staff specialized in handling Commercial Bond needs – License and Permit, Fidelity, ERISA, Business Services and Court Bonds – Miscellaneous Bonds