Bond Applications

Click on the links below to download PDF forms.

Contract Bond Applications

Bid, Payment, & Performance

Small Contractor Program Application – For Projects $400,000 and under

Contract Bond Application with Checklist – For Bonds larger than $400,000

SBA Supplemental Information – Include for consideration in the SBA Surety Bond Guarantee Programs

Additional Contract Bond Forms

Bond Request Form

Business Plan

Resume

Bank Reference Letter

Work on Hand Schedule

Job reference

Supplier reference check

Personal financial

Additional SBA Forms

SBA Fee Authorization Form

SBA Form 912

SBA Form 991

SBA Form 994

SBA Form 994F WOH

SBA Form 994R

Commercial Bond Applications

Don’t see the application you need? Contact Us

There are many types of additional commercial bonds that we can handle.

License and Permit Application

Motor Vehicle Dealer Bond Application

BMC – 84 (Freight or Property Broker) Bond Application

Wage & Welfare Bond Application

Utility Bond Application

Liquor Bond Application

Lost Title Bond Application

Probate/Guardian Bond Application

Business Service Bond Application

DEMPOS (Medicare) Bond Application

Fidelity/Crime Protection Contact Us

-This type of bond varies by type and amount, send us more information about the bond need to receive the correct application

Alabama Contract Bond ★ Payment & Performance ★ Bid ★ ERISA ★ Motor Vehicle Dealer Bonds ★ BMC-84 ★ Wage & Welfare ★ License and Permit ★ Commercial ★ Contract ★ Miscellaneous

Please Note: We can always get started working on accounts by looking at bond applications or submissions that you have already prepared for other markets.

CCI Surety, Inc. specializes in hard to place contract bonds that may have previously been declined by other sureties. We use different kinds of tools which allow us the freedom to think outside the box with our underwriting strategy. We are able to get comfortable with difficult situations using escrow / funds control, SBA Surety Bond Guarantee program and working capital deposits as different options to get the bond approved. CCI also has a very successful 3 x 5 program, which allows us to approve single bonds up to $300k and / or an aggregate program up to $500k, with just a two page application and no financials required. Our commercial Alabama Surety Bond business is handled in the home office. The commercial department handles both standard and non-standard Alabama Surety Bond needs.

Contract Bonds

– Multiple Markets

– Can Provide A+ rated bonds

– $3M in-house authority, up to $15M from home office

– Quick Turn around

– No Agency Requirements

SBA Backed Bonds

– 2012 National SBA Bond Producer of the Year

– Potential to approve bonds even with negative working capital

– SBA Bond Program now covers bonds up to $6.5M and in some cases $10M

Commercial Bonds

– Standard and Non-Standard Bonds

– Experienced staff specialized in handling Commercial Bond needs

– License and Permit, Fidelity, ERISA, Business Services and Court Bonds

– Miscellaneous Bonds

Have any idea to make this website easier to use? Please email jdillenburg@ccisurety.com

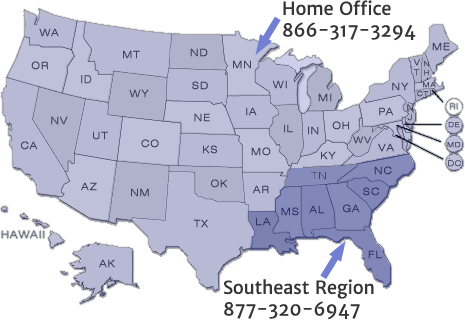

Our Southeast Region office handles surety bonds in Alabama, Florida, Georgia, Louisiana, Mississippi, North Carolina, and South Carolina.

Our Home Office handles surety bonds in Maine, Vermont, New Hampshire, Massachusetts, Connecticut, New York, Pennsylvania, New Jersey, Rhode Island, Delaware, Maryland, Virginia, West Virginia, Ohio, Kentucky, Tennessee, Arkansas, Texas, Oklahoma, Kansas, Missouri, Illinois, Indiana, Michigan, Wisconsin, Minnesota, Iowa, Nebraska, South Dakota, North Dakota, Montana, Wyoming, Colorado, New Mexico, Arizona, Utah, Idaho, Nevada, Oregon, Washington, California, Hawaii, Alaska, and Washington D.C.