SBA Bond Application

CCI Surety is a national leader in utilizing the US SBA Bond Guarantee Program

The SBA Bond Guarantee Program is designed to help small businesses obtain the bonds they need to participate on larger projects that require bonds. In recent years the program has been streamlined to help make it more accessible. CCI is experienced in utilizing the program and helps many contractors each year obtain bonds they might not have otherwise been able to obtain. An SBA Bond Application is located below, don’t hesitate to contact us with any questions.

CCI Surety is proud to have been awarded the 2012 National SBA Surety Bond Producer of the Year award.

SBA Bond Application

SBA Bond Producer of Year Award Letter

SBA Bond Requirements

- Project Size

Up to 2x the largest completed project. $6.5M single bond maximum on all contracts and up to $10M on federal projects.

Up to 15x-20x available working capital (for all projects).

– Current unused Bank Lines of Credit are included as working capital.

– Contractors with negative working capital may also be eligible using additional tools.

- Business Size

Allowable business sizes are based on total sales and the number of employees and are determined by the company’s NAICS code. Total sales can be as much as $33.5M in some cases.

- Financial Documents

Small contractors have varying levels of financial reporting and the SBA allows for varying levels of reporting based on contract size. One time exceptions to standard financial requirements may be allowed for some bond requests.

Required:

– Fiscal Year End (FYE) statement prepared within 90 days

– Minimum 6-month interim statement

– Bank line verification

Financial Statement Requirements:

| Project Size | FYE | Interim | |

| Up to $1.0M | In-House | In-House | (Possible with verification) |

| Up to $1.0M | Compilation | In-house | (Standard requirements) |

| $1.0M – $2.0M | Compilation | In-House | (Possible one-time exception) |

| $1.0M – $2.0M | Review | Compilation | (Standard requirements) |

Additional Tools

(For Negative or Insufficient Working Capital)

Escrow Agreements/Funds Control + 5% Escrow Deposit: The SBA Bond Program recognizes the value of utilizing escrow agreements and funds control to potentially mitigate risk on projects. Utilizing an escrow agreement and funds control process in addition to a 5% working capital deposit into the escrow account allows CCI to utilize the program even if the contractor has negative or insufficient working capital.

Additional Options: Although not typically used, additional forms of collateral or other considerations such as third party indemnity can also be utilized to approve a contractor for the SBA.

Please contact us to see how this program can apply to you or your client.

SBA Bonds ★ Payment & Performance ★ Bid ★ ERISA ★ Motor Vehicle Dealer Bonds ★ BMC-84 ★ Wage & Welfare ★ License and Permit ★ Commercial ★ Contract ★ Miscellaneous

Please Note: We can always get started working on SBA Bond submissions or applications that you have already prepared for other markets.

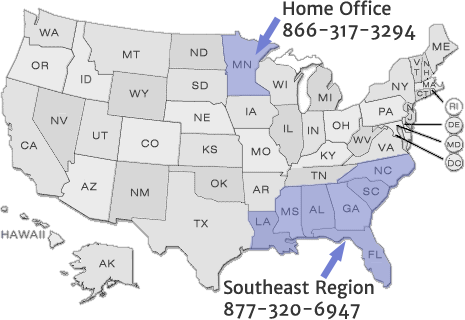

CCI Surety, Inc. specializes in hard to place contract bonds that may have previously been declined by other sureties. We use different kinds of tools which allow us the freedom to think outside the box with our underwriting strategy. We are able to get comfortable with difficult situations using escrow / funds control, SBA Surety Bond Guarantee program and working capital deposits as different options to get the bond approved. CCI also has a very successful 3 x 5 program, which allows us to approve single bonds up to $300k and / or an aggregate program up to $500k, with just a two page application and no financials required. Our commercial Alabama Surety Bond business is handled in the home office. The commercial department handles both standard and non-standard Alabama Surety Bond needs.

Contract Bonds

– Multiple Markets

– Can Provide A+ rated bonds

– $3M in-house authority, up to $15M from home office

– Quick Turn around

– No Agency Requirements

SBA Backed Bonds

– 2012 National SBA Bond Producer of the Year

– Potential to approve bonds even with negative working capital

– SBA Bond Program now covers bonds up to $6.5M and in some cases $10M

Commercial Bonds

– Standard and Non-Standard Bonds

– Experienced staff specialized in handling Commercial Bond needs

– License and Permit, Fidelity, ERISA, Business Services and Court Bonds

– Miscellaneous Bonds