Biggest Quick Bond Program

How to get biggest quick bond program

Quick programs work very well until you reach the upper limit of the bond program. Moving your client from one credit based quick bond program to another and searching biggest quick bond program is one option. Inevitably, even the biggest quick bond program will have a cap. Rather than a constantly moving your account to different sureties in a never ending search for the biggest quick bond program, you can set them up in a dynamic program with CCI Surety. We will start your contractor off in a quick bond program only if necessary. Our underwriters are experienced in growing with contractors that have some challenges. As soon as your contractor is ready for larger projects we can start increase their line, even without CPA Prepared financials.

Declined by biggest quick bond program

You may also work with contractors that get declined by a quick bond program before even getting to the biggest quick bond program. CCI Surety also specializes in working with contractors that have been declined by quick bond programs. CCI Surety’s programs could include contractors with low credit scores, past financial difficulties, or lack of financial sophistication. We have flexibility to find the biggest bond program possible for your contractors, even with challenges.

Low Credit Score Bond App – $400,000 and Under – Payment & Performance or Bid Bonds

2 Page Application for Low credit score Bond Situations

The CCI Surety Small Contractor Program is designed for contractors that have a low credit score situation that is limiting their bond capacity or causing them to be completely declined for bonds. There is no minimum credit score requirement for this program. Experience and other factors are weighed more heavily. This program is designed for construction projects $400,000 and under. This program also does not require company financials to qualify!

Low credit score Bond situations come in many forms and we see a lot of accounts that have low credit score or other challenges. Obtaining a bond when you have low credit score can be challenging for contractors and insurance agents that do not have a relationship with a surety that handles low credit score bond situations. CCI Surety handles low credit score bond accounts on a daily basis and our underwriters are trained to look beyond the low credit score score to look for opportunities to underwrite the bond. It may take more work but if your client has other strong attributes or experience then our underwriters will do their best to turn the low credit score bond situation into an opportunity. There are many ways to get started if you are facing a low credit score bond need. You can call CCI Surety directly or use the ‘connect with an underwriter’ area on this page or “Chat Now” below during business hours. It is also possible to get started with the applications below:

SHORT APPLICATION for Low credit score Bond Situations

Low Credit Score Bond App for Large Payment & Performance or Bid Bonds

CCI Surety can also handle large Bid or Performance and Payment Bonds when there is a low credit score situation. The application portion is the same as smaller projects but we need a little more supporting information. On larger projects where there is a low credit score score situation, we may need more company and personal financial information. We have many options, even on larger projects.

FULL SUBMISSION for projects over $400,000

Low credit score Bond – Commercial Application

Low credit score Bond situations can also come in smaller forms. These types of low credit score bond situations usually fall into our commercial bond department. There are many types of commercial, probate, court, and miscellaneous bonds. Contact us directly if you are not sure what type of bond you need, or if you have been declined for any type of bond due to a low credit score score.

Don’t see the application you need? Contact Us

There are many types of additional commercial bonds that we can handle.

License and Permit Bond Application

Motor Vehicle Dealer Bond Application

BMC – 84 (Freight or Property Broker) Bond Application

Wage & Welfare Bond Application

Utility Bond Application

Liquor Bond Application

Lost Title Bond Application

Probate/Guardian Bond Application

Civil Court Bond Application

Business Service Bond Application

ERISA Bond Application

DEMPOS (Medicare) Bond Application

Fidelity/Crime Protection Bond Contact Us

-This type of bond varies by type and amount, send us more information about the bond need to receive the correct application

Low credit score Bond – Performance Payment Application

Bid, Payment & Performance Bond Application

SBA Bid, Payment & Performance Bond Supplemental Page Application

Subdivision Bond Application

SBA Quick Application

If you are not sure which bond to use, contact us.

Jim Dillenburg

CCI Surety

jdillenburg@ccisurety.com

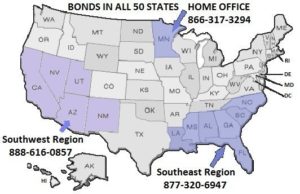

Our Home Office handles Low credit score Bond situations in Maine, Vermont, New Hampshire, Massachusetts, Connecticut, New York, Pennsylvania, New Jersey, Rhode Island, Delaware, Maryland, Virginia, West Virginia, Ohio, Kentucky, Arkansas, Texas, Oklahoma, Kansas, Missouri, Illinois, Indiana, Michigan, Wisconsin, Minnesota, Iowa, Nebraska, South Dakota, North Dakota, Montana, Wyoming, Colorado, Idaho and Washington D.C.

Our Southeast Region Office Handles Low credit score bonds in Florida, Georgia, Alabama, Mississippi, Louisiana, Tennessee, North Carolina, South Carolina, and Tennessee

Our Western Region Office Handles Low credit score bonds in Alaska, Arizona, California, Hawaii, Nevada, New Mexico, Oregon, Utah and Washington

Payment & Performance ★ Bid ★ ERISA ★ Motor Vehicle Dealer Bonds ★ BMC-84 ★ Wage & Welfare ★ License and Permit ★ Commercial ★ Contract ★ Miscellaneous

Please Note: We can always get started working on submissions or applications that you have already prepared for other markets. CCI Surety, Inc. specializes in hard to place contract bonds that may have previously been declined by other sureties because of low credit score or other financial situations. We use different kinds of tools which allow us the freedom to think outside the box with our underwriting strategy. We are able to get comfortable with difficult situations using escrow / funds control, SBA Surety Bond Guarantee program and working capital deposits as different options to get the bond approved. CCI also has a very successful Easy Start Program for contracts between $400,000 and $1,000,000 that may be obtained with a two page application plus any financial documents that are available. On commercial bond business we handle both standard and non standard business. Contract Bonds – Multiple Markets – Can Provide A+ rated bonds – $3M in-house authority, up to $15M from home office – Quick Turn around – No Agency Requirements SBA Backed Bonds – 2017 Top SBA Surety Bond Agent – 2012 National SBA Bond Producer of the Year – Potential to approve bonds even with negative working capital – SBA Bond Program now covers bonds up to $6.5M and in some cases $10M Commercial Bonds – Standard and Non-Standard Bonds – Experienced staff specialized in handling Commercial Bond needs – License and Permit, Fidelity, ERISA, Business Services and Court Bonds – Miscellaneous Bonds