Bid Bond Season

Non-standard Bid Bonds

Spring is the season of Bid Bonds in many parts of the country. Contractors often wait until the last second to acquire Bid Bonds which can leave insurance agents scrambling to place them. If you start working with a new client that needs bid bonds, remember that the surety typically requires the same level up underwriting for Bid Bonds as they do for Payment & Performance Bonds. Making sure you have all pertinent information during the Bid Bond process helps ensure that there will not be issues with the Payment & Performance Bonds. Credit score problems or other issues may pop up at any point in the bonding process. Reach out to CCI Surety for Bid Bonds, Payment & Performance Bonds, and other bond needs early.

We can usually get started from applications you have already filled out or you can choose from ours below. Contact us for commercial, court, or other bond applications.

SBA QUICK APPLICATION ($250K and Under)

For contractors with low credit score and little financial information availableEasy Start Application (Up to $1,000,000)

Submit with best available financials (in-house may be sufficient)Full Submission (Over $1,000,000)

CPA Financials generally required

Bid Bonds

Applying for a Bid or Payment and Performance Bond can be cumbersome. Many programs rely on credit score but CCI Surety can also handle bond needs for contractors with a low credit scores. There are many options for contractors with credit score or financial issues that need Bid or Payment and Performance bonds. CCI Surety reviews accounts for many options and can make multiple offers for contractors.

Jim Dillenburg

jdillenburg@ccisurety.com

866-317-3294

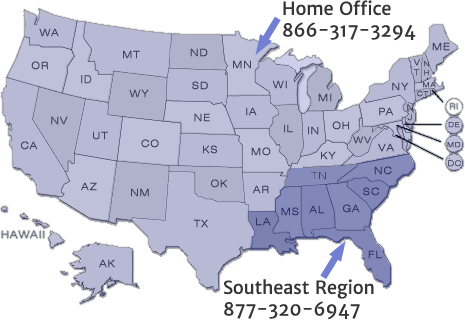

Our Home Office handles Bid Bond situations in Maine, Vermont, New Hampshire, Massachusetts, Connecticut, New York, Pennsylvania, New Jersey, Rhode Island, Delaware, Maryland, Virginia, West Virginia, Ohio, Kentucky, Tennessee, Arkansas, Texas, Oklahoma, Kansas, Missouri, Illinois, Indiana, Michigan, Wisconsin, Minnesota, Iowa, Nebraska, South Dakota, North Dakota, Montana, Wyoming, Colorado, New Mexico, Arizona, Utah, Idaho, Nevada, Oregon, Washington, California, Hawaii, Alaska, Florida, Georgia, Alabama, Mississippi, Louisiana, Tennessee, North Carolina, South Carolina and Washington D.C.

Payment & Performance ★ Bid ★ ERISA ★ Motor Vehicle Dealer Bonds ★ BMC-84 ★ Wage & Welfare ★ License and Permit ★ Commercial ★ Contract ★ Miscellaneous

Please Note: We can always get started working on submissions or applications that you have already prepared for other markets. CCI Surety, Inc. specializes in hard to place contract bonds that may have previously been declined by other sureties. We use different kinds of tools which allow us the freedom to think outside the box with our underwriting strategy. We are able to get comfortable with difficult situations using escrow / funds control, SBA Surety Bond Guarantee program and working capital deposits as different options to get the bond approved. CCI also has a very successful Easy Start Program for contracts between $250,000 and $1,000,000 that may be obtained with a two page application plus any financial documents that are available. On commercial bond business we handle both standard and non standard business. Bid Bonds – Multiple Markets – Can Provide A+ rated bonds – $3M in-house authority, up to $15M from home office – Quick Turn around – No Agency Requirements SBA Backed Bid Bonds – 2012 National SBA Bond Producer of the Year – Potential to approve bonds even with negative working capital – SBA Bond Program now covers bonds up to $6.5M and in some cases $10M Commercial Bonds – Standard and Non-Standard Bonds – Experienced staff specialized in handling Commercial Bond needs – License and Permit, Fidelity, ERISA, Business Services and Court Bonds – Miscellaneous Bonds